tax deferred exchange definition

More What Is a Reverse Exchange. Sometimes people say tax-free exchange but thats NOT accurate because the tax is only deferred until the day you sell the property and choose not to invest the money into a new one.

Irc 1031 Exchange 2021 Https Www Serightesc Com

Because capital gains taxes can take a huge chunk of profits a 1031.

. Well they should use it any time theyre selling an investment property theyve got a gain on. The QI creates legal distance between you and your 1031 transactions by. Although the numbers and the properties differ this is the type of question.

The Legal Information Institute wrote a solid technical answer. When someone sells assets in tax-deferred retirement plans the capital gains that would otherwise be taxable are deferred until the holder begins to cash out of the retirement plan. The 1031 Exchange allows you to sell one or more appreciated rental or investment real estate or personal property relinquished property and defer the payment of your capital gain and depreciation recapture taxes by acquiring one or more like-kind properties replacement property.

When selling real estate sellers can face significant tax obligations from the profit of the property sold. The Reverse Exchange is structured primarily with Revenue Procedure 2000-37 in mind. Like-kind properties according to the IRS are properties of the same nature character or class.

The termwhich gets its name from Internal Revenue Code IRC. 1031 Tax Deferred Exchanges allow you to keep 100 of your money equity working for you. The same principle holds true for tax-deferred exchanges or real estate investments.

Pass Your Real Estate Test - Guaranteed. The tax deferred exchange as defined in 1031 of the Internal Revenue Code offers taxpayers one of the last great opportunities to build wealth and save taxes. Those taxes could run as high as 15 to 30 when state and federal taxes are combined.

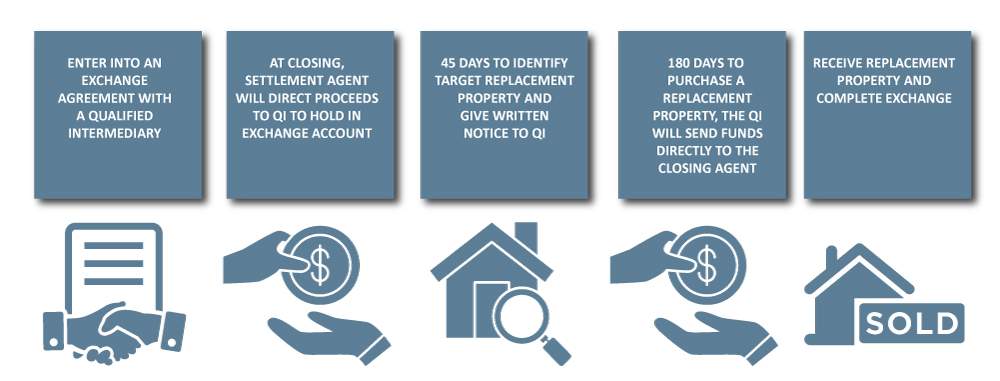

Eddie can acquire the new property. For example consider the traditional Individual Retirement Account IRA. A Qualified Intermediary QI helps taxpayers facilitate tax-deferred exchanges under Internal Revenue Code 1031.

A 1031 exchange is similar to a traditional IRA or 401k retirement plan. However by using the process of a 1031 Tax Deferred Exchange a property seller can. The gain may be taxable in the current year.

In the investment world tax deferred refers to investments on which applicable taxes typically income taxes and capital gains taxes are paid at a future date instead of in the period in which they are incurred. The theory behind Section 1031 is that when a property owner has reinvested the sale proceeds. A delayed exchange for practical purposes.

In real estate a 1031 exchange is a swap of one investment property for another that allows capital gains taxes to be deferred. What is Tax Deferred. It is not a tax-free event.

The formal rules for a QI are defined in Treas. How Does Tax Deferred Work. By completing an exchange the Taxpayer Exchanger can dispose of investment or business-use assets acquire Replacement Property and defer the tax that would ordinarily be due upon the sale.

Tax code defines a 1031 exchange as a like-kind exchange of one investment property for another in which capital gains tax liability is deferred. A tax-deferred exchange also referred to as a like-kind exchange a 1031 exchange a threeparty exchange or a Starker exchange may provide a way for you to take that 26000 apply it to the rental house purchase and delay the payment of the capital gains tax until you sell the new property. A deferred or reverse exchange thereby disqualifying the transaction from Section 1031 deferral of gain.

A tax-deferred exchange is a method by which a property owner trades one or more relinquished properties for one or more replacement properties of like-kind while deferring the payment of federal income taxes and some state taxes on the transaction. The company also offers strategic advisory asset management. But in todays world like I said a Starker exchange is just the everyday 1031 tax deferred-exchange.

If you own investment property and are thinking about selling it and buying another property you should know about the 1031 tax-deferred exchange. We want to help your 1031 exchange transaction go as smoothly as possible. 1031 Exchange 1031 tax deferred exchange Under Section 1031 of the IRS Code some or all of the realized gain from the exchange of one property for a like kind property may be deferred.

This property exchange takes its name from Section 1031 of the Internal Revenue Code. The 1031 tax-deferred exchange is a method of temporarily avoiding capital gains taxes on the sale of an investment or business property. As an example Eddie Exchanger finds a property that is a great deal but he needs to act quickly to buy it.

Not taxed until sometime in the future a tax-deferred savings plan. When do your clients normally use a Starker exchange. A reverse exchange Refers to method of executing a tax-deferred exchange aka 1031 exchange or like-kind exchange in which the exchanger or taxpayer acquires the replacement property before selling the property to be relinquished.

1031 Tax Deferred Exchange Explained. Section 1031 of the US. In summary a 1031 exchange is a way to defer the payment of these taxes- thats why it is referred to as a 1031 tax-deferred exchange.

This post was co-authored with John Starling Senior Vice President Northern 1031 Exchange LLC. By Randy Kaston on March 29 2022. In a tax-deferred exchange under Internal Revenue Code Section 1031 the sellertaxpayer is prohibited from receiving the proceeds from the sale of the relinquished property.

However in order to accumulate wealth the payment is deferred. And what exactly does that mean. This is a procedure that allows the owner of investment property to sell it and buy like-kind property while deferring capital gains tax.

A like-kind exchange is a tax-deferred transaction allowing for the disposal of an asset and the acquisition of another similar asset. If you would like to find out about the reverse exchange process or the tax deferred exchange process contact one of our experts today. On this page youll find a summary of the key points of the 1031 exchangerules concepts and.

What Is A 1031 Exchange Properties Paradise Blog

What Is A 1031 Exchange Dst How Does It Work And What Are The Rules

What Is Real Estate Rollover Definition Meaning Explanation

Hawaii Real Estate 1031 Exchange Buyers And Sellers Information

Is It A Good Idea To Do A 1031 Construction Exchange Of An Existing Rental Property To Build An Adu Granny Flat On Your Personal Residence What Are The Pros And Cons

All About 1031 Tax Deferred Exchanges Real Estate Investment Tips Youtube

1031 Exchange Explained What Is A 1031 Exchange

Can You Do A 1031 Exchange Into Reit All Section 721 Rules

What Is A 1031 Exchange Commercial Real Estate Md Va Dc

What Is A 1031 Tax Deferred Exchange Kiplinger

1031 Exchange When Selling A Business

Pdf Ias 12 Deferred Tax Assets Unused Tax Losses And Financial Crisis The Case Of Greece

1031 Exchange When Selling A Business

Tax Deferral How Do Tax Deferred Products Work

What Is The Benefit Of Tax Deferred Growth Great American Insurance

What Is A 1031 Exchange Asset Preservation Inc

Are You Eligible For A 1031 Exchange

Are Tax Deferred Exchanges Of Real Estate Approved By The Irs Accruit

/house-model-and-key-in-home-insurance-broker-agent--hand-or-in-salesman-person--real-estate-agent-offer-house--property-insurance-and-security--affordable-housing-concepts-1076671916-b5640d4fdc85432f9fd1a243b2a5d595.jpg)